Residential Aged Care Fees

Accomodation, Basic & Means Tested Fees

Aged Care Fee Types

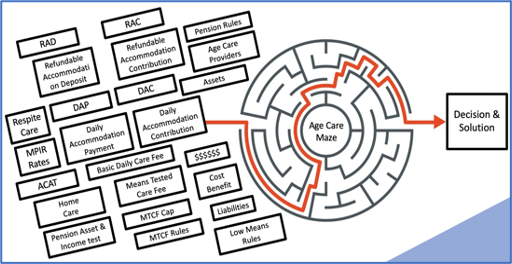

Residential aged care fees can be confusing and tricky. Each of these fees have been outlined below.

Accomodation Costs

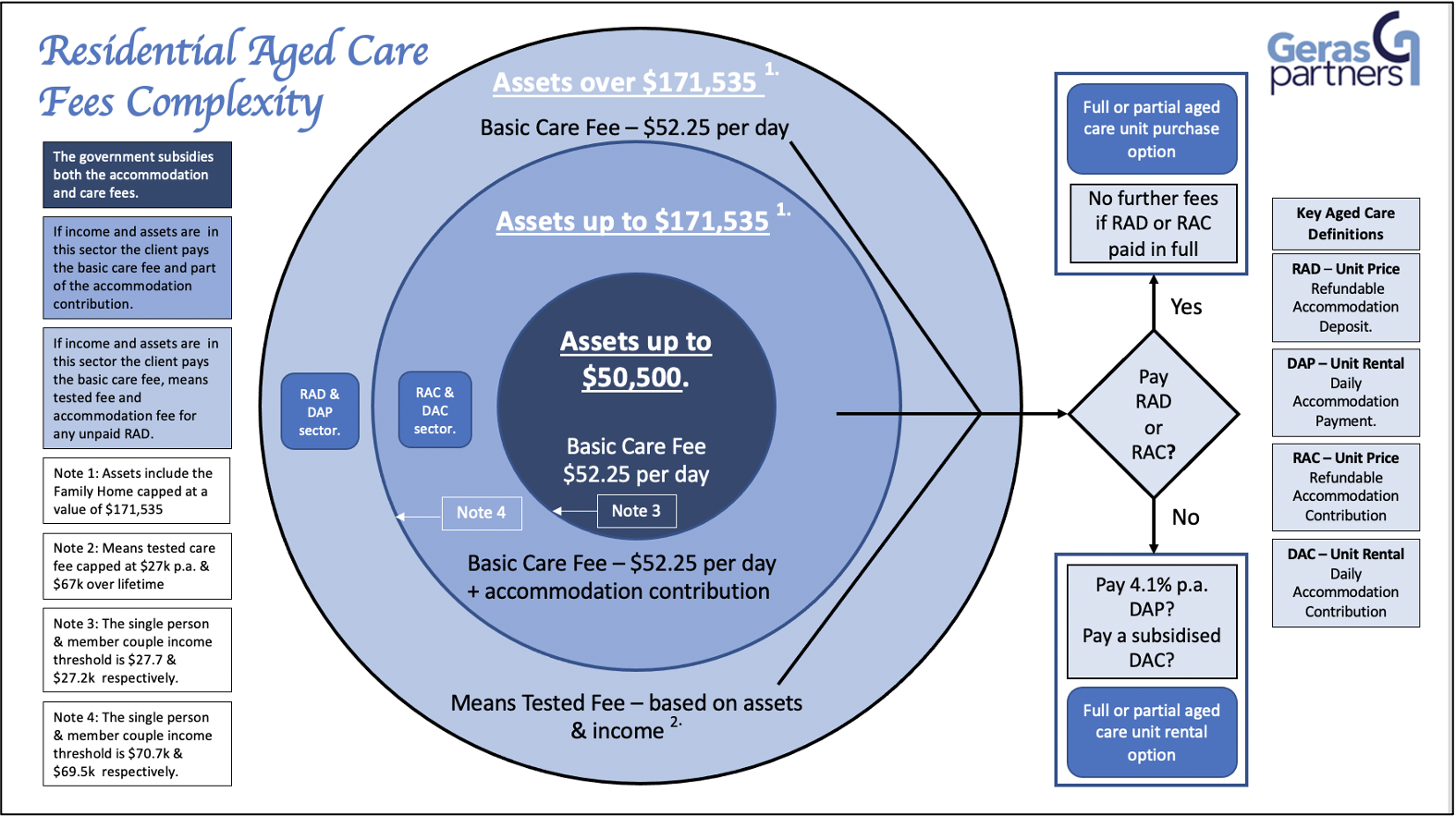

A person entering residential aged care will require residential aged care advice as to whether they will pay an accommodation payment or an accommodation contribution. The determination of the appropriate category is a function of the persons assessable income and assets as determined by the means tested amount calculation (see means tested fee (MTF) calculation on separate tab). The maximum accommodation supplement (MAS) which is announce every six months at end of March and September is used as the threshold point for determining if a resident will be considered as low means in determining the MTF calculation.

The MTF formula is described in detail on a separate tab on this page and is a key financial element of the Geras Partners aged care advice. In summary, the actuarial formula is derived from asset and income details so that the more income and assets that you have the higher will be your contribution to ongoing aged care costs.

Basic Daily Fee

Residential aged care fees also include a basic daily fee for all residents in care. Currently $55.25 per day and re-calculated each half year by DHS. The government does not subsides this fee there being no exemption for any resident.

Accomodation Payment

Where a resident has a means tested amount greater that the maximum accommodation supplements the resident will not be considered as low means and will pay an accommodation payment. In this case there is no government subsidy for the fees and residents will pay fees according to their asset and income means test calculation. The accommodation payment is calculated according to the maximum permissible interest rate (MPIR) announced by DHS and applicable to the providers published Refundable Accommodation Deposits (RAD’s) rates for an aged care home. The MPIR is currently 4.1% and is restated half-yearly. For a published RAD of $500,000 for example, the per annum amount would be $20,500 or $56.16 a day. The accommodation amount and the conversion to a daily rate is referred to as a daily accommodation payment (DAP). It may be possible to negotiate a different rate with the provider, but generally published rates apply.

The equivalent of a RAD for a low means client is the RAC which is calculated as the derivative of the agreed supplement, namely the daily rate x 365 divided by the MPIR. Residents have the option to invest in a RAD or a RAC in full or in part thus reducing the daily accommodation fees by an equivalent amount. We outline details regarding the RAD & RAC in more detail at

The MTF formula is described in detail at ………. and is a key financial element of the Geras Partners aged care advice. In summary, the actuarial formula is derived from asset and income details so that the more income and assets that you have the higher will be your contribution to ongoing aged care costs.

Accommodation Contribution

Where a person entering aged care has a means tested fee amount less than the maximum accommodation supplement (MAS) of $58.19 a day at the time of entry to aged care, they will pay an accommodation contribution. For those with a means tested fee amount greater than $58.19 they will pay an accommodation payment.

Those paying an accommodation contribution are considered low means and the government sponsor the daily fees. A low means resident will therefore pay the lesser of the calculated means tested amount and the accommodation supplement payable to the age care provider. The amount paid is referred to as the daily accommodation contribution(DAC)

Each quarter the residential aged care fee accommodation contribution will be recalculated by the DHS based on updated assets & income that determines the individual’s financial means. The accommodation supplement paid to the aged care provider is a function of whether the unit selected by the individual entering aged care is refurbished or not and is also determined by referring to the percentage of low means clients in the home being less than or greater that 40%.

Means Tested Fee

The MTF is designed to apportion more of the cost of residential aged care to those individuals and couples that have sufficient financial assets and income. The fee is payable on entry to residential aged care and is calculated by DHS(Centrelink) following receipt of relevant Residential Aged Care application forms SA485 or SA457. For every dollar of MTF paid the government pays one dollar less to the aged care provider.

The MTF is re-calculated each quarter based on assets and income. With a few exceptions the calculation process is based on the same asset and income Centrelink rules that apply to pension entitlement. There is an MTF annual cap of $28,087 and a lifetime cap of $67,409.85. In the case of a very high MTF a daily cap is determined by the providers daily cost of care.

The MTF calculation process is rather complex and for many in the aged care industry it remains something of a mystery with most referring to online services to generate the required fees for analysis and planning. The process is as follows and is key to optimising future residential aged care costs.

The daily MTF is calculated by referring to the previously mentioned Mean Tested Amount (MTA) and the Maximum Accommodation Supplement (MAS). The formula being:

MTF = MTA – MAS

MTA = (Income Amount + Asset Amount)/364

The MTA is calculated as outline in the following summary.

Asset Amount – Value of Assets

Home:

The family home is capped at $171,525.20 per individual. If there is a protected person living in the home, it is excluded from the asset calculation.

Other assets:

– Bank Balances: Face value

– Mutual Funds: Market value

– Shares: Market value

– Investment Property: Market Value

In the case of couples calculate total assets then split by 50%.

Asset Amount calculation threshold methodology:

– 0% on first $50,500

– 17.5% on assets between $50,500 & $171,535.20

– 1.0% on assets between $171,535.20 & $413,605.60

– 2.0% for assets over $413,605.60

– The above threshold applies for 30/6/2020

Income Amount – Assessable income

Income is calculated as follows:

– Pension less energy supplement

Deeming processes apply to:

– Bank accounts, Shares

– Unit trusts, Superannuation

– Investment property net income

– Loans offset with relevant asset

Deeming rate are currently as follows per annum:

Couples

– Combined assets up to $88,000 – 0.25%

– Combined assets above $88,000 – 2.25%

Individuals

– Combined assets up to $53,000 – 0.25%

– Combined assets above $53,000 – 2.25%

The income amount is then calculated as 50% of the assessable income above the following thresholds.

Single person: $27,736.80

Couple: $27,216.80 for each member of a couple

The income amount calculation for a person is therefore calculated as follows.

(Assessable income – less threshold) X 50%

In the case of couples, it is best to calculate total income then split by 50% to perform each individual’s calculation.

Additional Services

Aged care providers also offer additional non-standard services such a internet usage, telephone charges etc. These cost need to be carefully managed on entry to the home to be sure they are essential.

Illness separated couples

Couples often need to enter aged care in a staged approach as frailty prevails. In such cases the couple are considered “separated by illness” and move from a couples pension to single pension from the first entry to care. This strategy is very advantageous in funding aged care costs for those at the border-line in terms of available assets.