RAD Aged Care

Refundable Accomodation Deposit

RAD stands for Refundable Accomodation Deposit. When entering residential aged care there are three key payment options to be considered:

- Invest in the government guaranteed aged care unit. As previously described this investment is referred to as a Refundable Accommodation Deposit (RAD) or Refundable Accommodation Contribution (RAC) for low means clients requiring increased government sponsorship. When a full RAD is paid there are no further accommodation fees only the basic care fee and calculated means tested fee.

- Rental payments referred to as a Daily Accommodation Payment(DAP) or Daily Accommodation Contribution (DAC) for government sponsored residents.

- A combination of the above investment and rental options is a decision based on financial circumstances. In this case the basics care fee and calculated means tested fee will continue and the rental will be calculated on the unpaid RAD.

The Maximum Permissible Interest Rate (MPIR) that is announced each half year by DHS is used to calculate the equivalent rental payment on the providers published RAD. The current MPIR is 4.1% therefore for a RAD of $500k the daily rental (DAP) would be as follows:

- $500k X 4.01%/365 = Daily rental DAP ($54.93)

Within 28 days of entry residents have the option to decide as to whether they will pay all or part of the RAD or RAC as an investment in the aged care unit. The RAD and RAC has to be paid within six months if this nomination if made in the first 28 days. It is however best practice to not make the nomination to pay the RAD or DAP until future funding options are finalised and understood. Normal practice is to pay rental for the unit (DAP or RAC) and the resident has the option to nominate a RAD or RAC payment at a future date with all of the required funding secured.

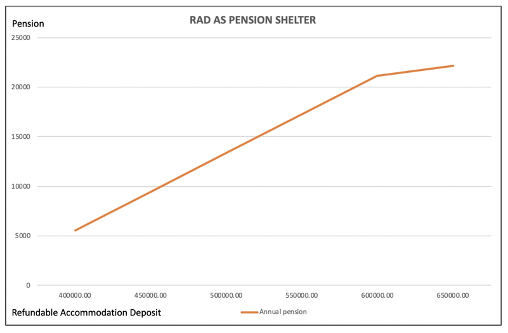

The RAD/RAC balance is not included in the pension assets test nor is it considered to generate deemed income under the pension income test. For residential aged care means tested fee calculation the RAD is included in the asset test however no deemed income is to be included in the income element of the means tested fee calculation.

If a family member pays part of the RAD or RAC this will be included in the asset test for the residential aged care means tested fee calculation.

Benefits of investing in RAD or RAC

As current interest rates are very low at 1% and expected to be at these levels for some time into the future the MPIR at 4.01% encourages families to invest in a RAD or RAC rather than pay the DAP or DAC as rental. This is especially the case where the resident owns their family home, this being the case for 3 out of 4 Australian over 65. Where there is home ownership the best option is usually the quick sale of the home with an investment in a RAD.

It is also important to recognise that an investment in a RAD or RAC is exempt for the pension assets test so there is often a strategic opportunity to optimise pension entitlement with increased RAD investments to the extent that the financial situation allows.

Return Of RAD

Where a resident move to a different aged care home the RAD is to be repaid within 14 days and interest paid at a base rate in the intervening period.

The RAD is government guaranteed for all approved aged care providers so the balance will be returned to the estate within 14 days after the grant of probate or letters of administration. Aged care provider must also pay interest on the RAD balance at the MPIR rate if it is not repaid in the 14 day period.

Questions to consider in evaluating the buy(RAD/RAC) or rent (DAP/DAC) options

Assuming the family home is sold:

Questions to consider if the family home is rented to support aged care costs?

Assuming the family home is sold: